Cancer continues to be a pressing health concern affecting millions of lives worldwide. According to the World Health Organization (WHO), cancer is the second leading cause of death globally, responsible for an estimated 10 million deaths in 2020 alone.

The incidence of cancer continues to rise, with new cases projected to increase by about 70% over the next two decades (Source: International Agency for Research on Cancer). Cancer encompasses a wide range of diseases, affecting various organs and systems. Common types include breast, lung, colorectal, prostate, and pancreatic cancer, each with its own unique challenges and treatment approaches.

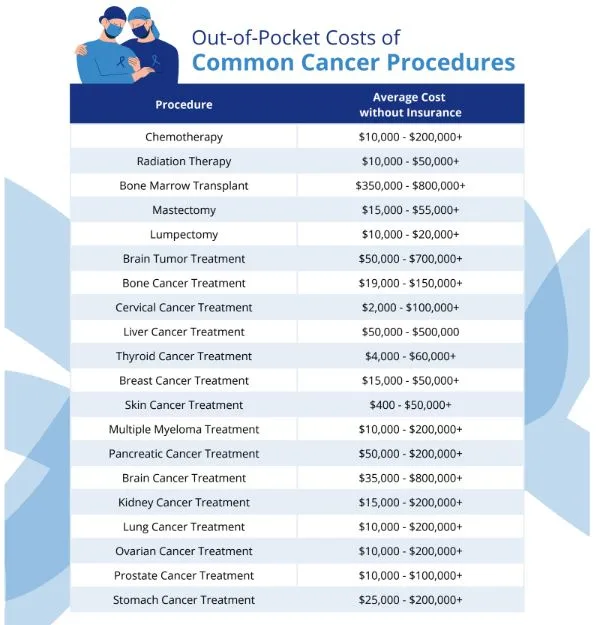

Beyond the physical and emotional toll that cancer exacts on patients and their loved ones, the financial burden it leaves behind can be overwhelming. The chart below shows the out-of-pocket costs for common cancer procedures. These expenses represent what one can expect to pay without any form of cancer coverage. Enrolling in a cancer insurance plan can alleviate much of this financial stress, ensuring you receive the care you need.

Cancer insurance, also known as cancer-specific insurance or critical illness insurance, is a type of insurance coverage designed to provide financial protection in the event of a cancer diagnosis. Here is some information on what cancer insurance typically covers and why it may be beneficial to consider having a plan:

What Cancer Insurance Covers:

- Lump Sum Payment: Upon diagnosis of a covered cancer, cancer insurance policies often provide a lump sum payment. This lump sum can be used at the policyholder’s discretion to cover various expenses associated with cancer treatment and recovery.

- Treatment Expenses: Cancer treatments can be costly, even with health insurance. Cancer insurance may help cover expenses related to surgery, chemotherapy, radiation therapy, immunotherapy, targeted therapy, and other approved treatments.

- Experimental Treatments: In some cases, cancer insurance may provide coverage for certain experimental or alternative treatments that may not be covered by regular health insurance.

- Hospital Stays and Accommodation: Cancer insurance plans may cover hospital stays, including the cost of room and board. Some policies may also include coverage for accommodation during treatment, such as hotel stays near treatment centers.

- Rehabilitation and Aftercare: Cancer insurance may cover expenses related to rehabilitation services, physical therapy, counseling, and other forms of aftercare.

- Second Opinions: Many cancer insurance plans offer coverage for seeking second opinions from medical experts, helping policyholders make informed decisions about their treatment options.

Some Benefits of Cancer Insurance:

- Financial Protection: Cancer can bring significant financial burdens, including medical bills, lost income due to inability to work, travel costs, and other related expenses. Cancer insurance can provide a financial safety net by offering a lump sum payment to help offset these costs.

- Supplement to Health Insurance: While health insurance covers a portion of medical expenses, it may not cover all costs associated with cancer treatment. Cancer insurance can fill in the gaps, offering additional financial support specifically for cancer-related expenses.

- Flexibility and Control: Cancer insurance provides policyholders with the flexibility to use the lump sum payment as needed. It allows individuals to make decisions about their treatment, seek alternative therapies, or cover other financial obligations during their cancer journey.

- Peace of Mind: Having cancer insurance can provide peace of mind by alleviating concerns about the financial impact of a cancer diagnosis. It allows individuals to focus on their treatment and recovery without added financial stress.

Insureous Health Solutions’ professionals can help you select a cancer insurance plan that best suits your individual needs and circumstances. By taking proactive steps, we can ensure that financial worries do not overshadow the fight against cancer and pave the way for a brighter and more secure future. You can call us at 904-295-8498.