Are you a small business owner looking for a smarter way to offer benefits, attract top talent, and keep your team happy? Whether you currently offer group medical plans or are just starting to explore benefits, INSUREOUS has a Benefit Innovation for Your Group (B.I.G.) solution designed specifically for you.

The Challenge: Balancing Budget with Employee Needs

You know that a robust benefits package is crucial for attracting and retaining great employees. But traditional group benefits can be costly and inflexible, making it tough to manage your budget while meeting diverse employee needs.

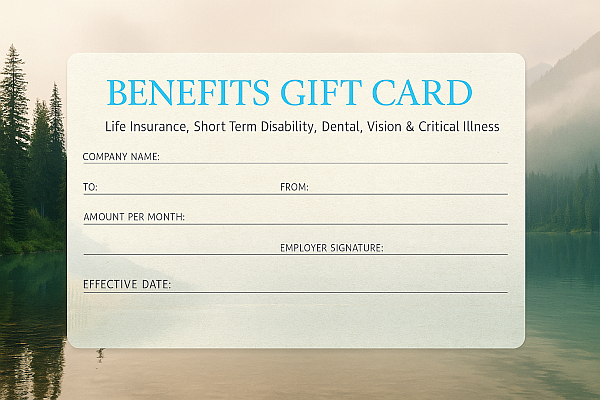

The Solution: A Defined Contribution Approach for Ancillary Benefits!! We’ve designed an innovative Defined Contribution approach that empowers both you and your employees. It’s simple, predictable, and incredibly valuable.

Here’s How it Works?

- You Set Your Budget: You identify a fixed monthly premium allocation for all eligible employees – a “Defined Contribution” starting at a minimum of $25/month (or $.14 cents per hour). This gives you control over costs and keeps expenses predictable year-to-year.

- You Choose the Benefits to Offer: Select from a comprehensive portfolio of ancillary benefits, including Basic Life, Voluntary Term Life, Dental, Vision, Short Term Disability, Long Term Disability, and Critical Illness.

- Your Employees Take Control: Employees are “empowered” to spend their employer premium allocation and can even purchase additional benefits easily through payroll deduction. They get to choose the benefits that best fit their individual needs, maximizing the return on your benefit expense.

What Makes This Different?

- No Census Required for Smaller Groups: For groups with 6 to 99 lives, rates are driven by SIC codes and zip codes, eliminating the need for a complex census input. (For groups of 100+, a census is required, along with claims experience for STD & Dental).

- Guarantee Issue: All benefits are Guarantee Issue.

- Flexible Participation: There’s no participation requirement for most benefits (Basic Life requires 100% participation, and LTD requires a minimum of 2 enrolled employees).

- Rate Guarantees: Enjoy a 3-year rate guarantee on all benefits.

What are the benefits to the Employer?

- Manage Your Budget: Gain control over costs and ensure predictable expenses year over year.

- Recruit and Retain Top Talent: Enhance the value of your employee benefit package, making your company more attractive to new hires and helping you keep your best employees.

- Increased Return on Investment: Maximize your benefit expense as employees align their benefit elections with the exact benefits they want.

- One more big plus: You will enjoy the significant advantage of placing your groups on a state-of-the-art benefits enrollment & management platform at no cost.

Customizable Options for Your Group:

You have the flexibility to select the specific benefit plan designs that best suit your team. Here’s a glimpse of the choices:

- Basic Life/AD&D Plan Designs: Choose from four employer options for coverage amounts (e.g., $10,000, $15,000, $25,000, $50,000) with optional dependent coverage.

- Voluntary Term Life Plan: Offer with or without matching AD&D benefits.

- Short Term Disability Plan Designs: Determine if premiums are employer-paid (taxable) or employee-paid (non-taxable). Select from various plan designs and benefit options, such as 60% not to exceed $1,250/week, Flat $100/week, or Flat $200/week.

- Dental Plan Designs: Choose from multiple options with varying deductibles, coverage percentages (e.g., 100/80/0, 100/80/50, 100/100/60), annual maximums, and optional orthodontia.

- Vision Benefit Plans: A simple “YES, WILL BE OFFERING” option.

- Critical Illness: Another “YES, WILL BE OFFERING” option.

What’s the next Step?

Let’s talk about your group specifically and how INSUREOUS can help you build a truly impactful and affordable benefits package.

(Call to Action Button/Link):

Get a Personalized Proposal Today!

(Small print/disclaimer): This is a basic overview of these benefits. and not a policy or contract Please refer to your formal proposal and policy for all details, underwriting guidelines and exclusions Not all Products are available in all states. Group must be eligible for product offering according to Underwriting guidelines.